Master Card Market: Insights and Competitive Analysis

"Executive Summary Master Card Market :

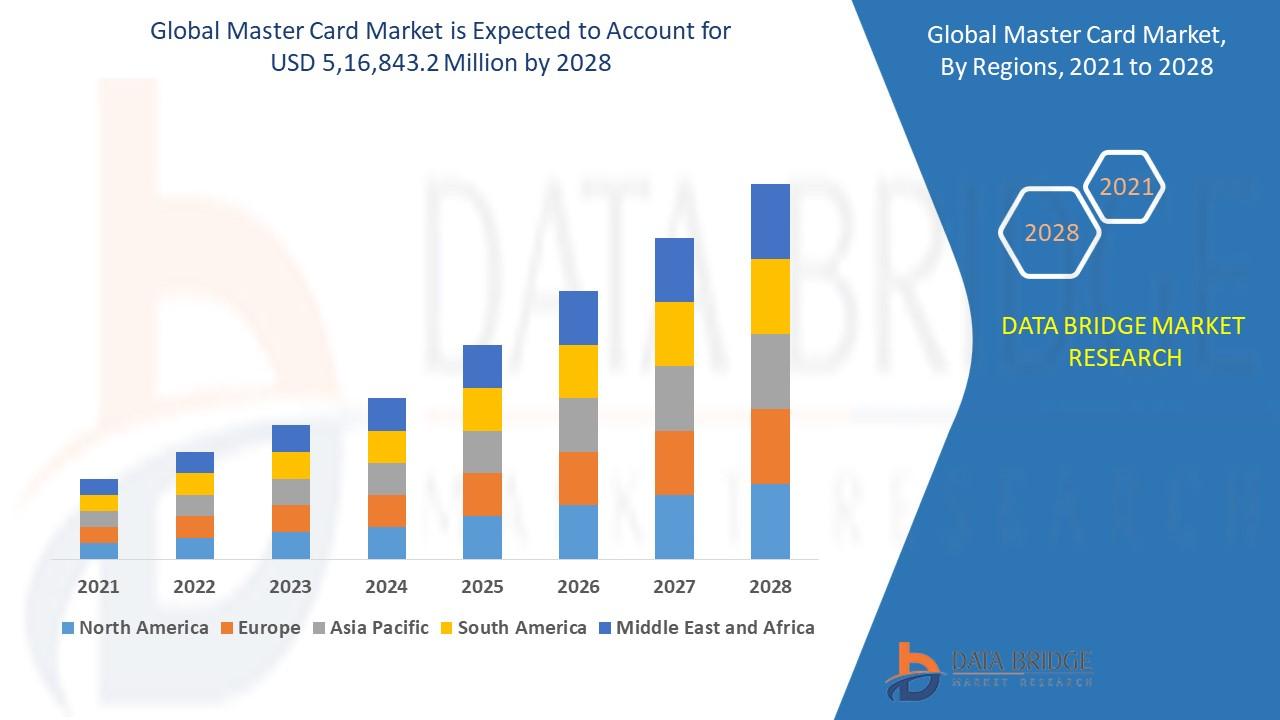

The global master card market will reach at an estimated value of USD 5,16,843.2 million and grow at a CAGR of 12.30% in the forecast period of 2021 to 2028. Rise in the availability of the internet and the deluge of e-commerce stores is an essential factor driving the master card market

A market research analysis and estimations carried out in this Master Card Market report aids businesses in gaining knowledge about what is already there in the market, what market looks forward to, the competitive background and steps to be followed for outdoing the rivals. With the comprehensive analysis of the market, it puts forth overview of the market regarding type and applications, featuring the key business resources and key players. Further, manufacturer can adjust production according to the conditions of demand which are analysed here. The Master Card Market underlines the global key manufacturers, to define, describe and analyze the market competition landscape with the help of SWOT analysis.

Graphs, TOC, and tables included in the report help understand the market size, share, trends, growth drivers and market opportunities and challenges. This report presents with the key statistics on the market status of global and regional manufacturers and also acts as a valuable source of leadership and direction. The company profiles of all the key players and brands that are dominating the market have been given in this report. The statistical and numerical data are represented in graphical format for a clear understanding of facts and figures. With this report not only an unskilled individual but also a professional can easily extrapolate the entire market within a few seconds.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Master Card Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-master-card-market

Master Card Market Overview

**Segments**

- By Card Type: Debit Cards, Credit Cards, Prepaid Cards

- By End User: Banking Institutions, Financial Institutions, Retailers, Government

Mastercard's dominance in the global market is evident through its wide range of card offerings catering to different needs. Debit cards continue to be the most popular choice among consumers for everyday transactions, while credit cards offer additional benefits and rewards for users. Prepaid cards are also gaining traction, particularly for individuals who want to control their spending or do not have access to traditional banking services. In terms of end users, banking institutions are the primary adopters of Mastercard services, followed by financial institutions, retailers, and even government entities for various payment needs.

**Market Players**

- Mastercard Inc.

- Visa Inc.

- American Express

- Discover Financial Services

- PayPal Holdings, Inc.

- JP Morgan Chase & Co.

- Bank of America Corporation

- Citibank

- Wells Fargo

- Barclays

Mastercard faces stiff competition in the market from major players such as Visa, American Express, and Discover Financial Services. These companies also offer a wide range of card products and payment solutions, creating a competitive landscape in the global market. In addition to traditional financial institutions, digital payment platforms like PayPal Holdings, Inc. have also emerged as key players in the industry, challenging the dominance of traditional card networks. Other major players in the market include JP Morgan Chase & Co., Bank of America Corporation, Citibank, Wells Fargo, and Barclays, all of whom contribute to the dynamic nature of the Mastercard market.

The global Mastercard market continues to exhibit dynamics driven by evolving consumer preferences, technological advancements, and regulatory changes. One key trend shaping the market is the increasing adoption of contactless payments, spurred by the need for convenience, speed, and enhanced security. Mastercard has been at the forefront of promoting contactless payments globally, collaborating with various stakeholders to expand acceptance and drive consumer awareness. This trend is expected to continue shaping the market landscape, with Mastercard leveraging its expertise in digital payments to capitalize on the growing demand for seamless and secure transactions.

Another significant development in the Mastercard market is the rising prominence of mobile wallets and digital platforms as preferred payment channels. With the proliferation of smartphones and the increasing reliance on digital solutions, consumers are gravitating towards mobile payments for their convenience and accessibility. Mastercard has been proactive in fostering partnerships with mobile wallet providers and fintech companies to enhance its digital capabilities and reach a broader customer base. As mobile payments become increasingly mainstream, Mastercard is well-positioned to leverage its technological infrastructure and network to drive growth and innovation in the market.

Furthermore, the ongoing shift towards e-commerce and online shopping has presented new opportunities and challenges for Mastercard and other market players. With the surge in digital transactions, particularly in the wake of the COVID-19 pandemic, there is a growing emphasis on enhancing the security and efficiency of online payments. Mastercard's emphasis on tokenization, biometric authentication, and fraud prevention technologies underscores its commitment to ensuring safe and seamless digital transactions for consumers and merchants alike. As e-commerce continues to gain traction globally, Mastercard's focus on innovating its payment solutions for the digital economy will be crucial for maintaining its competitive edge in the market.

Additionally, regulatory developments and compliance requirements pose both risks and opportunities for Mastercard and the broader market ecosystem. As regulatory scrutiny intensifies on issues such as data privacy, cross-border payments, and anti-money laundering measures, Mastercard must navigate a complex regulatory landscape to ensure compliance and mitigate risks effectively. Collaborating with regulatory authorities, industry associations, and other stakeholders will be paramount for Mastercard to address regulatory challenges proactively and uphold its reputation as a trusted and compliant payment network provider.

In conclusion, the global Mastercard market is characterized by dynamic trends, evolving consumer behaviors, and technological advancements that continue to reshape the payments landscape. By embracing innovation, forging strategic partnerships, and prioritizing security and compliance, Mastercard is well-positioned to capitalize on emerging opportunities and drive growth in an increasingly digital and interconnected world.Mastercard's strategic positioning in the global market is underscored by its proactive approach to embracing emerging trends and technological advancements in the payment industry. The increasing adoption of contactless payments represents a significant shift in consumer behavior towards more convenient and secure transaction methods. By championing contactless payment solutions and collaborating with stakeholders to enhance consumer awareness and acceptance, Mastercard is solidifying its foothold in the market. This trend is not only driving operational efficiency but also catering to the evolving needs of tech-savvy consumers who prioritize speed and convenience in their payment experiences.

Moreover, the surge in mobile wallets and digital platforms is reshaping the payment landscape, offering consumers seamless and accessible payment options. Mastercard's strategic partnerships with mobile wallet providers and fintech firms highlight its commitment to expanding its digital capabilities and reaching a wider customer base. As mobile payments become increasingly mainstream, Mastercard's efforts to leverage its existing network and technological infrastructure position it favorably to capture a growing segment of digitally inclined consumers. By capitalizing on the opportunities presented by the rising prominence of mobile payment channels, Mastercard can drive innovation and expand its market reach in the evolving digital economy.

Furthermore, the transition towards e-commerce and online shopping presents both challenges and opportunities for Mastercard to enhance its payment solutions and security measures. As digital transactions continue to proliferate globally, the emphasis on robust security protocols, tokenization, and fraud prevention technologies is paramount to ensure consumer trust and confidence in online payments. Mastercard's commitment to innovation in addressing the security and efficiency of digital transactions not only safeguards its market position but also reinforces its reputation as a reliable payment network provider amidst the evolving cybersecurity landscape.

Additionally, navigating the ever-evolving regulatory environment and compliance landscape is crucial for Mastercard to sustain its market leadership and uphold its reputation as a compliant payment network. Given the increasing regulatory scrutiny on data privacy, cross-border transactions, and anti-money laundering measures, Mastercard's collaboration with regulatory bodies and industry stakeholders is essential to proactively address regulatory challenges and mitigate associated risks effectively. By prioritizing compliance and working closely with regulatory authorities, Mastercard can demonstrate its commitment to maintaining the highest standards of governance and integrity in the global payments ecosystem, ensuring sustainable growth and resilience in an evolving regulatory landscape.

In conclusion, Mastercard's market strategy revolves around agility, innovation, and collaboration to navigate the dynamic shifts in consumer preferences, technological advancements, and regulatory imperatives shaping the global payments landscape. By capitalizing on emerging trends, fostering strategic partnerships, and prioritizing security and compliance standards, Mastercard is well-positioned to drive growth, foster customer loyalty, and sustain its competitive edge in an interconnected and digital-centric market environment.

The Master Card Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-master-card-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

The investment made in the study would provide you access to information such as:

- Master Card Market [Global Master Card Market – Broken-down into regions]

- Regional level split [North America, Europe, Asia Pacific, South America, Middle East & Africa]

- Country wise Market Size Split [of important countries with major Master Card Market share]

- Market Share and Revenue/Sales by leading players

- Market Trends – Emerging Technologies/products/start-ups, PESTEL Analysis, SWOT Analysis, Porter's Five Forces, etc.

- Market Size)

- Market Size by application/industry verticals

- Market Projections/Forecast

Browse More Reports:

Global Light-Emitting Diode (LED) Phototherapy System Market

Middle East and Africa Trash Bags Market

Global Electric Dryers Market

Global Lid Applicator Machine Market

Global Powdered Disposable Gloves Market

Global Erotic Lingerie Market

Asia Pacific Orthopedic Surgical Energy Devices Market

Global Product Information Software Management Market

Global Ovarian Cancer Drug Market

Global Wine Yeast Market

Latin America Contact Lenses Market

Global Wireless Headphones and Earphone Market

Global Portable Pressure Washer Market

Global Cheese Ingredients Market

Global Storage Area Network (SAN) Solutions Market

Global Styrenic Block Copolymers Market

Global Industrial Drum Market

Global Sweet Modulators Market

Global Television Services Market

Global Baseball Equipment Market

Global Operational Predictive Maintenance Market

Global Surface Haptics Technology Market

Global Automotive Testing Inspection and Certification (TIC) Market

Global Blood Meal for Poultry Feed Market

Asia-Pacific Internal Neuromodulation Devices Market

Global Periportal Fibrosis Market

Middle East and Africa Prebiotics for Infant Formula Market

Global Hazmat Packaging Market

Global Functional Gummies and Jellies Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness